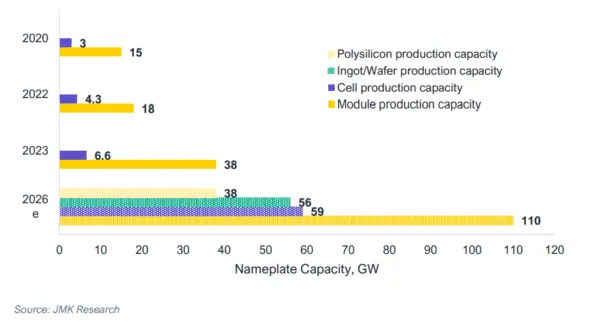

A new joint report published by the Institute of Energy Economics and Financial Analysis (IEEFA) and JMK Research and Analytics, states that with 110 GW of solar module production capacity set to come online in the next three years, India will become self-sufficient and the world’s second-largest module manufacturer after China by 2026.

By 2026, India is expected to make a significant contribution to the upstream components of PV manufacturing, with solar cell capacity projected to reach 59 GW, ingots/wafers to 56 GW, and polysilicon to 38 GW.

As the next stage, the country should compete for dominance in both quality and scale in the global PV market, says Vibhuti Garg, Director, South Asia, IEEFA and the report’s co-author.

India’s cumulative module manufacturing capacity more than doubled from 18 GW in March 2022 to 38 GW in March 2023. The favourable policies introduced by the Indian government were cited as one of the biggest drivers of this growth.

“The production-linked incentive (PLI) scheme is one of the primary catalysts spurring the growth of the entire PV manufacturing ecosystem in India. Besides the augmentation of infrastructure in all stages of PV manufacturing, from polysilicon to modules, it will also lead to the simultaneous development of a market for PV ancillary components, such as glass, ethylene vinyl acetate (EVA), and backsheets,” said Jyoti Gulio, founder of JMK and a co-author of the report.

Gulio also states that Gujarat is the leading state when it comes to PV module manufacturing installations, accounting for nearly 57% of the upcoming manufacturing capacity. The top reason for companies favouring Gujarat includes low industrial electricity prices and easier access to ports for import and export.

Major Hurdles

The report identified India’s reliance on China for upstream PV components such as polysilicon and ingots/wafers as one of the chief hurdles to the growth of PV manufacturing. The document also reveals that almost 95% of such components are sourced from China currently.

Another major obstacle is the lack of skilled manpower, especially in upstream component manufacturing.

The report recommends augmenting the PLI scheme to include upstream components, PV equipment machinery, and ancillary components for more holistic development of the module manufacturing industry.

“Moreover, as part of the long-term expansion plan, India must aim to build enough PV capacity to satisfy local demand and maintain a healthy global presence to become a viable competitor to Chinese PV products,” it adds.

Click Here for more updates

Resource: The Hindu

Leave A Comment