In the energy sector, coal captures more market than solar. But the new major investment of NTPC (National Thermal Power Company), which is India’s largest power company, in renewable energy may stop the consumption of cola energy for good.

Last year (the year 2020), NTPC has committed to building a 32 GW target of renewable energy by 2032. But in the last week, NTPC has doubled up this target to 60 GW.

NTPC said that they are not sure about the future renewable energy mix till now. Would it be 100% from solar energy or the mix of solar and wind energy? But If NTPC (National Thermal Power Company) goes to solar energy entirely, they will generate 60 GW of total capacity by 2032. This 60 GW would be around one-fifth of India’s expected solar installations to that date. That target is not too hard to achieve for NTPC, as currently, they owned 17% of the power market share, in-which more than 90% of fossil fuel-fired.

Seeing the present carbon footprint situation in India, any addition to renewable energy is good. But the move of NTPC towards renewable energy raises the question about the future condition of the nation’s coal fleet.

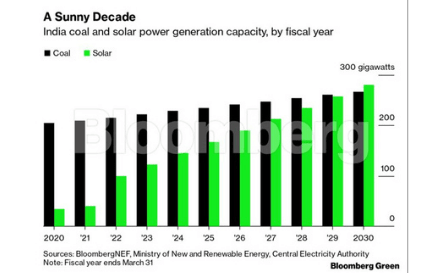

However, government projections and BloombergNEF analysis suggest that solar will overtake coal by the end of 2030. Solar capacity will expand 700% in the next 10 years; coal will expand, too, but only by 30%.

Image Source: Bloomberg

But this prediction about coal energy doesn’t decide the exact condition of India’s coal fleet right now. It might be high or not. In India, fossil-fuel-based power generation relies mostly on coal. But as per the report, the consumption rate of coal is declined in 2019 & 2020 also.

At the same time, the fleet of coal-fired plants kept growing. Spread a declining total amount of power generation over an expanding fleet and the math is simple: operating hours, or plant utilization, fell. NTPC and the other state-owned power generators have the highest utilization rates, which were still north of 60% last year. Privately owned plants were barely above 50%; state government-owned plants were well below 50%.

The higher the utilization rate, the easier it is to pay off a plant’s substantial capital costs and return money to shareholders. If the plant utilization rate is below then 50%, it is a bad situation because it is half the cash flow of a fully operating plant while the fixed costs are the same. Meanwhile, according to an analysis by BNEF (BloombergNEF), the power from newly-built solar capacity in India is now cheaper than the power from existing Indian gas and coal plants.

That’s why the decision of NTPC to double its renewable energy commitment may impact the future of thermal energy.

On the earnings call of NTPC (National Thermal Power Company), Finance Director Mr. A.K. Gautam said, “Additional renewable energy commitments of NTPC will not result in a change of its thermal fleet expansion plans — at least not yet. The company is waiting for a new committee under the country’s Central Electricity Authority to produce supply and demand projections. Once that comes in maybe a year or so, we will look into our number and accordingly restructure it.”

Click Here for more updates Ornatesolar.com

Leave A Comment